When lending, bet on the trend, not a point in time

Credit risk models built with Zest AI's technology have already scored more than 6.1 million loan applications. Around the six million mark, we decided to write down the biggest lessons we’ve learned about where consumer lending is going with AI and machine learning.

Bet on the trend and not a point in time when lending

Part of the hesitancy to lend down the credit spectrum is an inability to trust legacy credit scores to make an accurate risk assessment for the middle band of applicants. You know, those folks who often fall into a "gray area" on the credit spectrum.

Two borrowers with the same score may represent completely different risk profiles to a lender. One applicant with a 650 score might be on their way to a 700, while the other may be heading in the opposite direction. You can’t spot these distinctions by using generic scores that rely on only a handful of data points pulled at a specific point in time. What you need is to use a richer set of trended data — which means including as many trade lines as feasible — to better assess the credit profile of applicants.

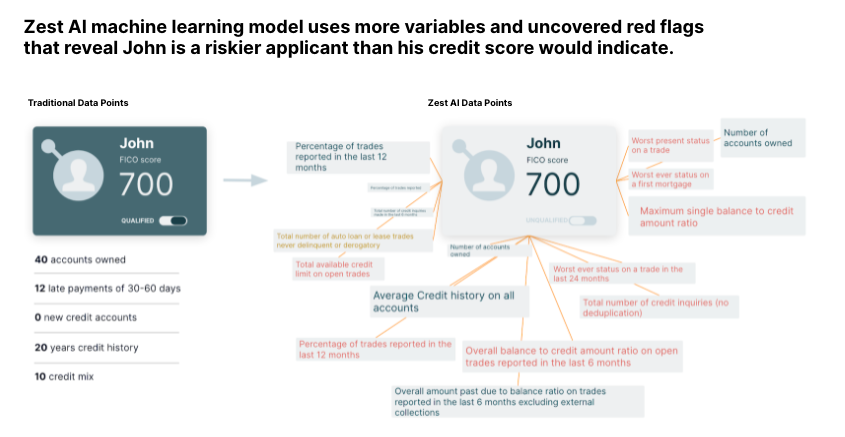

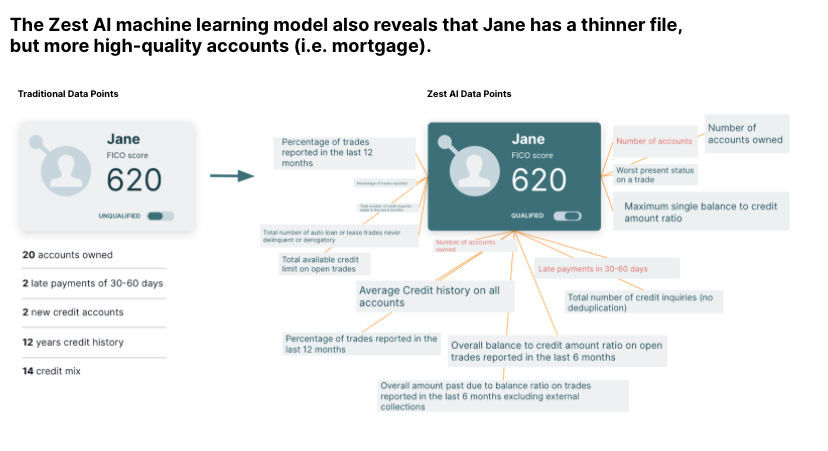

Machine learning models generate their advantage over generic scores by incorporating hundreds more variables than traditional models can handle and tapping into millions of correlations to provide more nuanced views of consumers that lead to increased approvals and fewer losses.

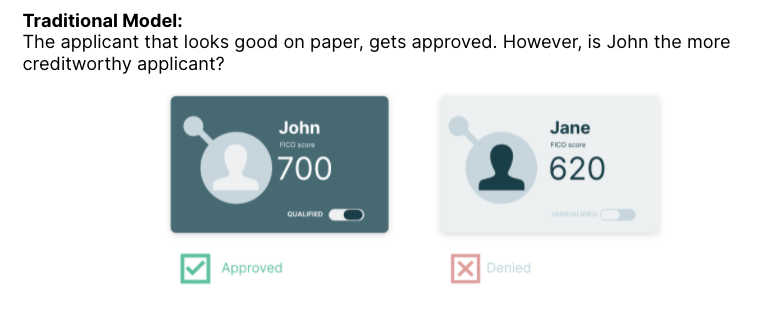

Here’s an illustration of what we’re talking about. A traditional model would look at applicants John and Jane and almost certainly approve John over Jane based on their traditional, generic scores. But is John the more creditworthy applicant?

Not exactly. A Zest AI-built machine learning models use more data, especially trended variables, to uncover the red flags that indicate John is a riskier applicant than his credit score would indicate.

By using far more trended variables from Jane’s credit file, the Zest-built model extracts a lot more insight from fewer accounts. It turns out she has more high-quality and current accounts such as her mortgage.

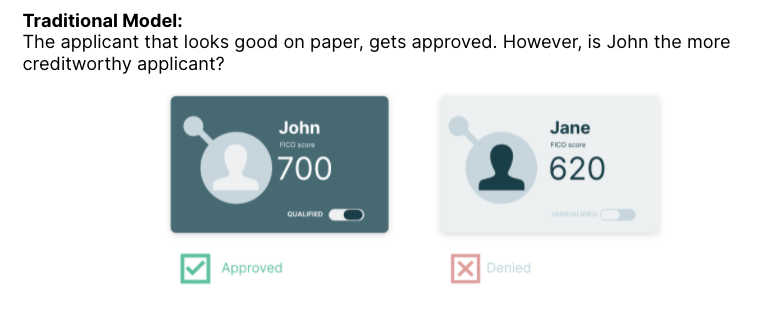

Result? John is denied and Jane is approved.

One question we often get: How do you get trended data for down-spectrum borrowers without a lot of credit history? Certainly, if there’s no history, we're not going to make it up with synthetic data. That would be far from compliant. But ML models can easily accommodate lenders interested in going deeper down the credit spectrum by ingesting cash flow data from rent, cell phone bills, utility bills, and first-party savings or checking accounts. You can get a lot of predictive signals from looking at how people use their money. The industry is already moving in this direction because it produces better models than simplistic generic scores.